Supply Chain Is 40% of Inflation

The Big Picture

NOVEMBER 17, 2022

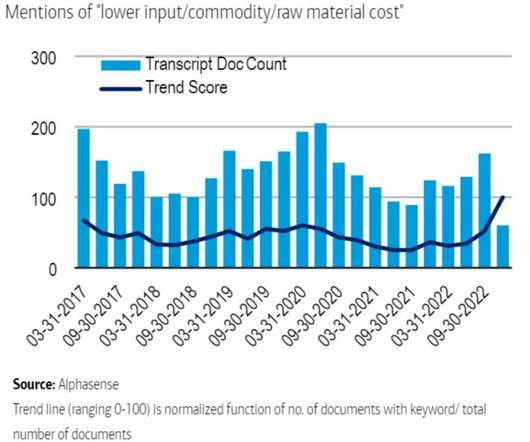

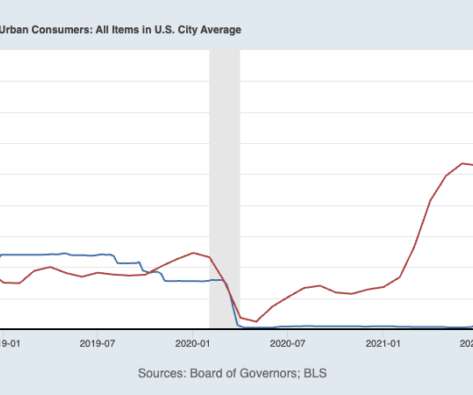

. There is a new 60/40 in town, and it is the contribution to inflation from consumer demand for goods and the pandemic-broken supply chain. That is according to a study by Julian di Giovanni, who publishes at the NY Fed’s blog Liberty Street Economics. Over the summer, he posed a fascinating question: How Much Did Supply Constraints Boost U.S. Inflation?

Let's personalize your content