Can private equity meet public responsibilities?

Financial Times: Moral Money

OCTOBER 11, 2023

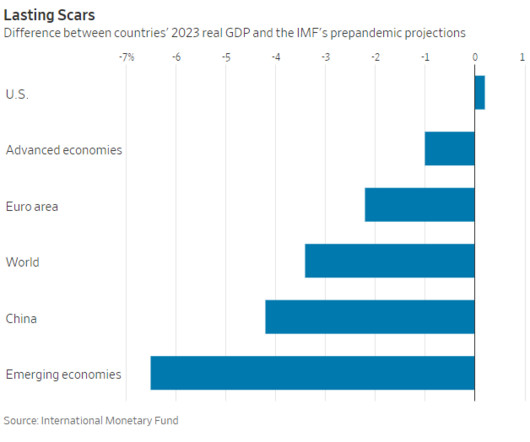

The sums of capital the sector wields could be critical to financing a sustainable economy, but greater transparency and accountability are needed to ensure this happens

Let's personalize your content