Why Super Micro Computer Stock Rocketed to New Highs This Week

The Motley Fool

FEBRUARY 1, 2024

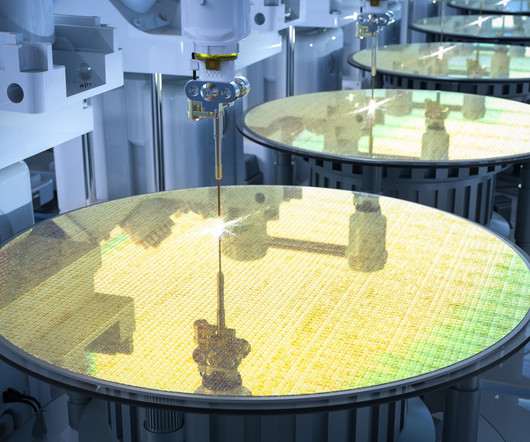

Week to date, shares of Super Micro Computer (NASDAQ: SMCI) were up 23% through Thursday's market close, according to data provided by S&P Global Market Intelligence. The demand for artificial intelligence (AI)-driven computing is driving accelerating revenue growth and profits for this leading supplier of rack-scale solutions for data centers. Despite the stock's massive run over the last year, the company is seeing market share gains for its products and raised full-year revenue guidance.

Let's personalize your content