Nvidia Just Bought 5 Artificial Intelligence (AI) Stocks, and 1 Is Up 142% Already

The Motley Fool

APRIL 6, 2024

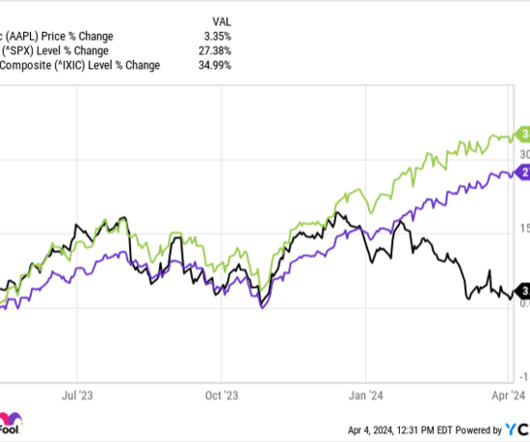

Nvidia (NASDAQ: NVDA) was a $360 billion company at the beginning of 2023. It has added $1.8 trillion in value since then, and it's now the third-largest company in the world behind only Apple and Microsoft. The heightened interest in artificial intelligence (AI) is the primary driver of that value creation. Nvidia makes the industry's most powerful graphics processing units (GPUs) for data centers, which developers use to build, train, and deploy their AI models.

Let's personalize your content