Bill Gates Has $34 Billion Invested in Just 5 Stocks

The Motley Fool

DECEMBER 22, 2023

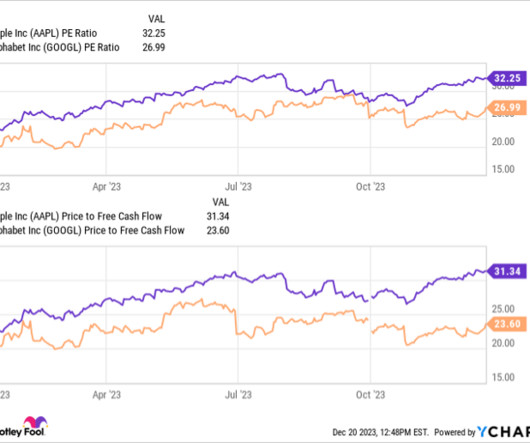

The Bill and Melinda Gates Foundation Trust has a whopping $39 billion invested in the stock market, and a vast majority of those funds are in just a few stocks. Some of that is because of donations, but the fund is also buying some interesting industrial stocks. In this video, Travis Hoium covers the foundation's holdings and how the portfolio came to be what it is.

Let's personalize your content