The Ultimate Growth Stock to Buy With $1,000 Right Now

The Motley Fool

DECEMBER 27, 2023

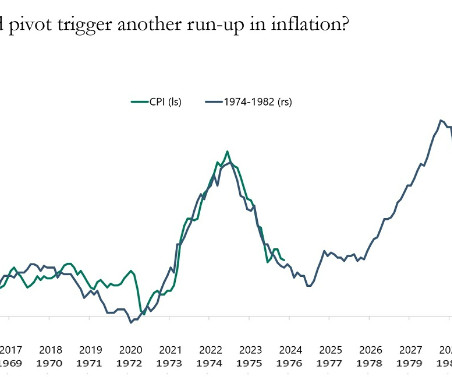

After a dismal performance last year, growth stocks came roaring back in 2023 thanks to several tailwinds such as cooling inflation, the Federal Reserve's pause on interest rate hikes, a strong economy, and the reduced probability of a recession. That rally is expected to continue in 2024 as well. Personal finance news provider Kiplinger estimates that S&P 500 companies could witness an 11% increase in earnings in 2024, up significantly from this year's growth of 2.3%.

Let's personalize your content