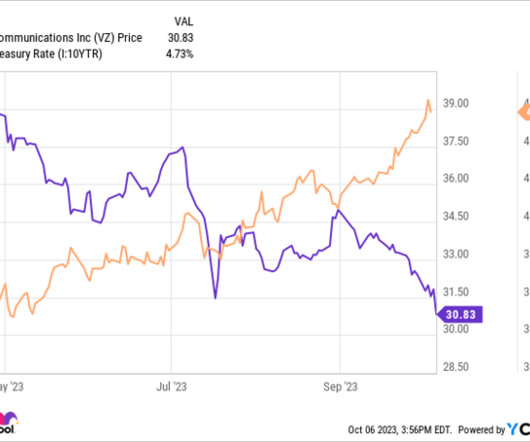

Why VinFast Auto Stock Plunged More Than 30% This Week

The Motley Fool

OCTOBER 6, 2023

What happened Shares of VinFast Auto (NASDAQ: VFS) are falling fast and furious this week -- they were down a whopping 36.7% through 10:25 a.m. ET Friday, according to data provided by S&P Global Market Intelligence. With this week's dramatic drop, the electric vehicle (EV) stock -- which made a sizzling debut in the U.S. in August -- is now 90% off its peak.

Let's personalize your content