The Best Time to Buy Stocks

A Wealth of Common Sense

MAY 28, 2023

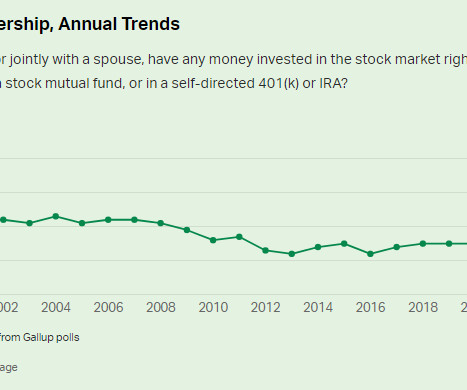

The top 10% own nearly 90% of the stocks. That’s the bad news. The good news is more people now own stocks in some capacity. That hasn’t always been the case. The 1929 crash that kicked off the Great Depression was a massacre. The stock market fell more than 80%. Plenty of people got wiped out but it wasn’t as widespread as you would think.

Let's personalize your content