Nvidia Just Dropped Great News for Super Micro Computer Stock

The Motley Fool

MARCH 16, 2024

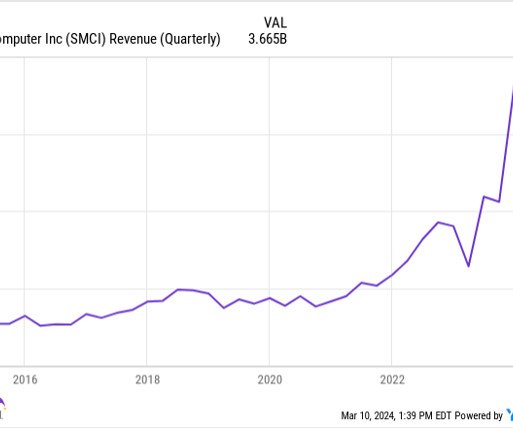

Share prices of Super Micro Computer (NASDAQ: SMCI) took off in the past year, gaining 1,180% as of this writing, and a big reason behind the stock's red-hot surge is the booming demand for Nvidia 's (NASDAQ: NVDA) artificial intelligence (AI) graphics cards. Supermicro's modular server rack-scale systems are being used to mount AI-related graphics cards from Nvidia , as well as other chipmakers.

Let's personalize your content