Bull Market Indicator or Bear Market Rally? History's Message for Where Stocks Could Head Next

The Motley Fool

AUGUST 10, 2023

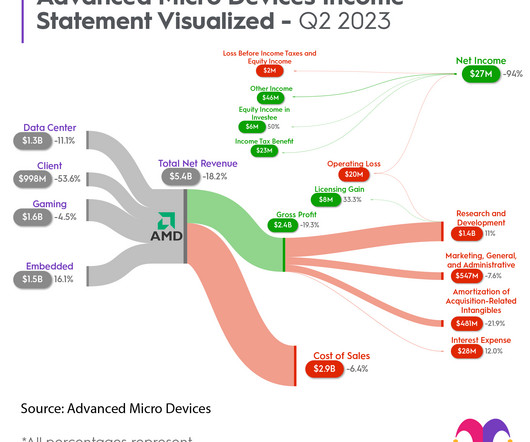

The Invesco QQQ (NASDAQ: QQQ) ETF has been on a tear so far in 2023. Here's what history shows as a possibility for what could happen next. Of course, technical analysis is not some magical crystal ball, and long-term investors always prosper, but these three charts are something to be aware of as we move to a seasonally weak period for the stock market.

Let's personalize your content