1 Weight-Loss Stock That's Been a Hotter Buy Than Eli Lilly and Novo Nordisk This Year

The Motley Fool

SEPTEMBER 7, 2023

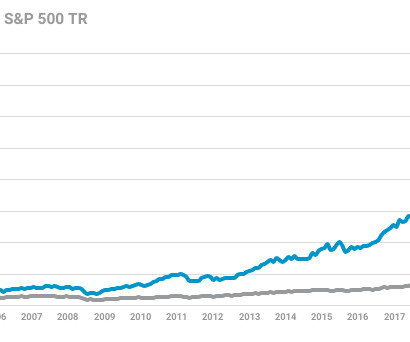

Ozempic, Wegovy, and Mounjaro. If you've been following weight-loss stocks, you know those are the drugs that have been driving a lot of the bullishness behind Eli Lilly and Novo Nordisk this year, as they've been helping people lose significant weight. Both healthcare stocks have been soundly beating the markets this year and are up over 40%. But as hot as they have been, there's been one weight-loss stock that has been doing even better: WW International (NASDAQ: WW).

Let's personalize your content