PEWIN appoints Emily Mendell as executive director

PE Hub

OCTOBER 3, 2023

Mendell has previously held leadership positions at NVCA and ILPA. The post PEWIN appoints Emily Mendell as executive director appeared first on PE Hub.

PE Hub

OCTOBER 3, 2023

Mendell has previously held leadership positions at NVCA and ILPA. The post PEWIN appoints Emily Mendell as executive director appeared first on PE Hub.

Private Equity Professional

OCTOBER 3, 2023

Publicly traded Carlisle Companies has closed the sale of Carlisle Fluid Technologies to Lone Star for $520 million in cash. Carlisle Fluid Technologies (CFT) is a manufacturer of products and systems for the supply, application and curing of sprayed materials including paints, coatings, powders, mastics (resins) and bonding materials. Company-owned brands include BGK, Binks, DeVilbiss,… This content is for members only.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PE Hub

OCTOBER 3, 2023

UK-based Banks Renewables is an operator of onshore wind farms. The post Brookfield to acquire Banks Group’s renewable energy unit appeared first on PE Hub.

Private Equity Professional

OCTOBER 3, 2023

Middle market investor Kelso & Company has held an above target close of Kelso Investment Associates XI LP with capital commitments of $3.25 billion. Included in Fund XI’s capital is participation by Kelso partners and employees of more than $400 million. Limited partners in Fund XI include public and corporate pensions, sovereign wealth funds, insurance… This content is for members only.

PE Hub

OCTOBER 3, 2023

Bristol Precast is an engineered precast and prestressed concrete product manufacturer. The post Solace Capital-backed Fabcon buys Bristol Precast appeared first on PE Hub.

Private Equity Professional

OCTOBER 3, 2023

KLH Capital has acquired eTech Environmental & Safety Solutions in partnership with the company’s senior management team. eTech provides its services – environmental consulting, soil sampling and testing, remediation, waste management, and compliance services – to blue-chip customers in the upstream, midstream, government, and industrial end markets throughout the Permian Basin, a sedimentary basin in… This content is for members only.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Private Equity Professional

OCTOBER 3, 2023

Align Capital Partners (ACP) has announced the launched of a new independent sponsor-focused private equity strategy, Align Collaborate. ACP founded Align Collaborate in partnership with independent sponsor investors, Grant Kornman and Michael Kornman. Prior to forming Align Collaborate, the Kornmans co-founded NCK Capital, a Dallas-based lower-middle market independent sponsor that invests in companies with $2… This content is for members only.

PE Hub

OCTOBER 3, 2023

Avenu is an administrative, revenue enhancement and payment software and service provider. The post Arlington Capital to buy Avenu Insights & Analytics appeared first on PE Hub.

A Wealth of Common Sense

OCTOBER 3, 2023

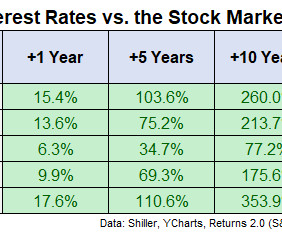

Over the past few months, there has been a swift re-rating in longer-term bond yields. The 10 year treasury is now yielding around 4.8%, up from a low of 3.3% as recently as April. It was yielding 3.7% in July. Many pundits believe the bond market is only now waking up to the potential of a higher-for-longer interest rate regime caused by strong labor markets, a resilient economy, higher-than-expected inflation and Fed po.

PE Hub

OCTOBER 3, 2023

ADT Commercial will rebrand as Everon and operate as a standalone organization. The post GTCR wraps up ADT’s commercial fire and security biz acquisition appeared first on PE Hub.

Integrity Financial Planning

OCTOBER 3, 2023

Transforming a distributor or reseller into a valuable company may seem like a daunting task. Distributors are usually not worth very much, because an acquirer reasons that without a point of differentiation, a distributor is vulnerable to a price war. Rather than acquire a target company, a savvy potential acquirer of a distributor could temporarily lower their price for whatever is being distributed and woo most of the target company’s customers without acquiring the company.

PE Hub

OCTOBER 3, 2023

HighVista is an employee-owned alternative asset manager based in Boston. The post HighVista completes acquisition of Abrdn’s US private markets biz appeared first on PE Hub.

Million Dollar Round Table (MDRT)

OCTOBER 3, 2023

By Julianne Hertel, CLU, ChFC As financial advisors and life insurance agents, we love helping our clients. Yet, if our clients are put off by some of the phrases or terminology we use, then it can become an obstacle. Fortunately, there are different words we can use. Language matters. When we change our words with clients, we can make the financial planning experience better for them and change their expectations when we take them on a journey to reaching their dreams.

PE Hub

OCTOBER 3, 2023

TRG Screen is an enterprise subscription spend and usage management software provider. The post Vista Equity to acquire TRG Screen from Pamlico Capital appeared first on PE Hub.

AltAssets

OCTOBER 3, 2023

Brookfield Asset Management has made a huge GP commitment as part of its $12bn fundraise for its sixth flagship private equity vehicle. The post Brookfield raises $12bn for its biggest-ever private equity fund, pledges huge amount in GP commitment first appeared on AltAssets Private Equity News.

PE Hub

OCTOBER 3, 2023

The all-cash deal, expected to close in the first half of 2024, is valued at about $170 million. The post Canada’s iA Financial to acquire JC Flowers-backed Vericity appeared first on PE Hub.

AltAssets

OCTOBER 3, 2023

T Rowe Price and Oak Hill Advisors have launched a new private credit fund with an initial $1.5bn of investable capital. The post T Rowe Price, Oak Hill ready for $1.5bn of private credit dealmaking with new fund first appeared on AltAssets Private Equity News.

PE Hub

OCTOBER 3, 2023

Thomas Ashbourne Craft Spirits is a cocktail brand. The post InvestBev infuses capital into Thomas Ashbourne Craft Spirits appeared first on PE Hub.

AltAssets

OCTOBER 3, 2023

Mid-market New York buyout house Kelso & Co has beaten its target for its latest flagship fundraise by pulling in $3.25bn at final close. The post Kelso clears Fund XI goal to reach $3.25bn after two years of fundraising first appeared on AltAssets Private Equity News.

PE Hub

OCTOBER 3, 2023

EQT and PSP closed their $3bn take-private deal for Radius Global Infrastructure in September. The post EQT’s Alex Greenbaum: Digital connectivity will drive increased demand for Radius’ sites appeared first on PE Hub.

Financial Times M&A

OCTOBER 3, 2023

US buyout firm foots bill for lawyers to assess potential claim against rival over €200mn loan loss

PE Hub

OCTOBER 3, 2023

Vista Equity Partners buying a software business from Pamlico Capital; EQT’s Alex Greenbaum on recent take-private of Radius Global Infrastructure; a sports media investment by RedBird Capital Partners and International Media Investments; and a cocktail play by InvestBev Group. The post Vista to buy TRG Screen from Pamlico; EQT talks cell tower leasing; PEWIN appoints Emily Mendell appeared first on PE Hub.

AltAssets

OCTOBER 3, 2023

Impact investor Blue Earth Capital has boosted its assets under management to more than $1bn through the final close of a dedicated credit impact fund. The post Blue Earth Capital boosts AUM past $1bn with above-target credit impact fund close first appeared on AltAssets Private Equity News.

PE Hub

OCTOBER 3, 2023

Beyond Technologies is a Montreal-based professional services company specializing in SAP solution integration and business performance optimization. The post Novacap-backed Syntax Systems to buy Beyond Technologies appeared first on PE Hub.

The Reformed Broker

OCTOBER 3, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Rising Rates Hurt – “Investors fear unsustainably high interest rates will spark bank-loan defaults” ►Utilities Crash – Utilities are underperforming the S&P 500 32% YTD.

PE Hub

OCTOBER 3, 2023

Sugar Foods is a multinational food products company. The post Pritzker Private Capital scoops up Sugar Foods appeared first on PE Hub.

Insight Partners

OCTOBER 3, 2023

May Habib’s previous company, Qordoba, was around two years old when an AI research paper was published that would change the course of her career – and the wider AI world. Titled ‘Attention Is All You Need ,’ the June 2017 paper introduced the world – including Habib and co-founder Waseem Alshikh – to the concept of AI transformers, a type of deep learning architecture that excelled at learning and applying context.

PE Hub

OCTOBER 3, 2023

TSP is a structural steel product supplier. The post Slate Capital-backed OMD snaps up Tombari Structural Products appeared first on PE Hub.

The Reformed Broker

OCTOBER 3, 2023

Interest rates are rising because economic growth is better than expected, says Cerity’s Lebenthal from CNBC Final Trades: Starbucks, Cisco & more from CNBC

PE Hub

OCTOBER 3, 2023

Everise is a global healthcare services outsourcing company. The post Warburg Pincus agrees to invest in Everise appeared first on PE Hub.

Financial Times M&A

OCTOBER 3, 2023

Air France-KLM and private equity group Castlelake become investors alongside Danish government

PE Hub

OCTOBER 3, 2023

Operating out of three locations on Vancouver Island, Harbord provides a diverse range of products, including home, auto, travel, recreation and marine. The post Madison Dearborn-backed Navacord buys Harbord Insurance appeared first on PE Hub.

Private Capital Investment in Latin America

OCTOBER 3, 2023

Registration is now open for LAVCA Week 2023 LAVCA Week convenes leading private capital investors from Latin America and around the globe each year for a series of meaningful discussions…

Top 1000 Funds

OCTOBER 3, 2023

The market has already entered the early stages of a multi-year restructuring cycle that will present many opportunities for credit providers. Researchers and investors from GIC, CalPERS and IMCO recommend some organisational changes that will ensure asset owners can make the most of those opportunities.

Let's personalize your content