Massive News for Fisker Stock Investors

The Motley Fool

SEPTEMBER 14, 2023

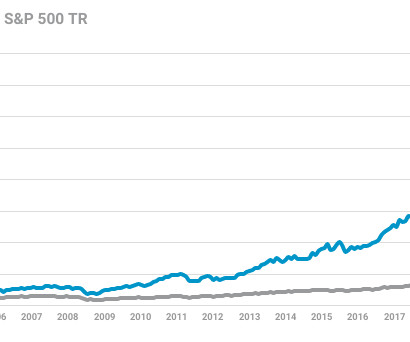

Fool.com contributor Parkev Tatevosian evaluates the latest news coming out of Fisker (NYSE: FSR) and what it could mean for investors. *Stock prices used were the afternoon prices of Sept. 11, 2023. The video was published on Sept. 13, 2023. 10 stocks we like better than Fisker When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has tripled the market.* They just revealed what they believe are the te

Let's personalize your content