2 Cheap Cannabis Stocks to Avoid in October

The Motley Fool

SEPTEMBER 28, 2023

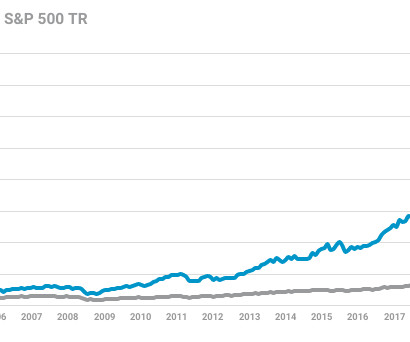

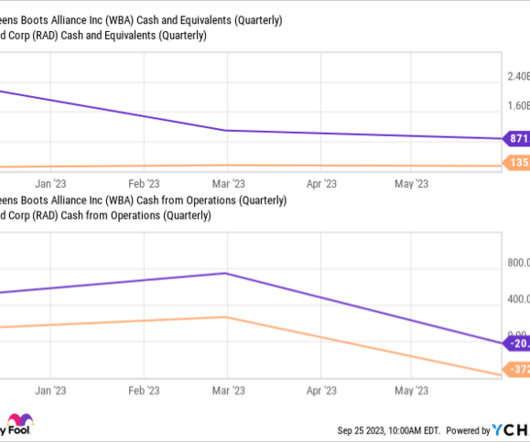

Cannabis stocks aren't exactly in vogue right now. All of the biggest public marijuana companies massively underperformed the market over the last 12 months, with nearly all of them losing a lot of their value, and there may not be relief in sight. For the bargain-hunting investor, now is the ideal time to be on the lookout. But not every bruised stock is a genuine opportunity, and many are likely to lose even more value, at least in the near term.

Let's personalize your content