Why I'm Selling All My Pure-Play Adtech Stocks, Except for The Trade Desk

The Motley Fool

AUGUST 23, 2023

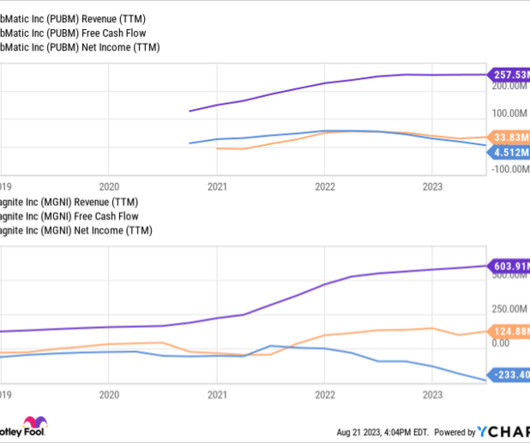

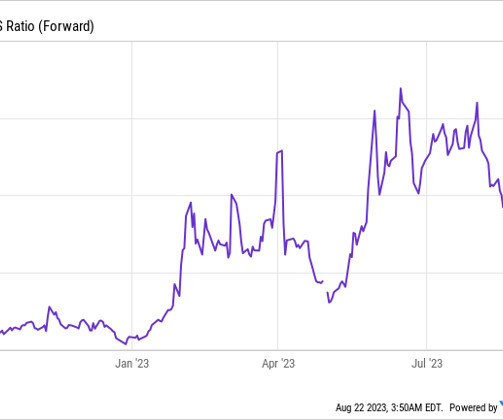

I've been slowly whittling down my various investments in advertising-technology platforms over the last few years. Around this time in 2022, I parted ways with Magnite (NASDAQ: MGNI). This late summer/early autumn, it will be PubMatic (NASDAQ: PUBM) , leaving me with just one pure-play advertising-platform stock remaining: The Trade Desk (NASDAQ: TTD).

Let's personalize your content