Target Is Doing Its Best Costco Impression

The Motley Fool

APRIL 11, 2024

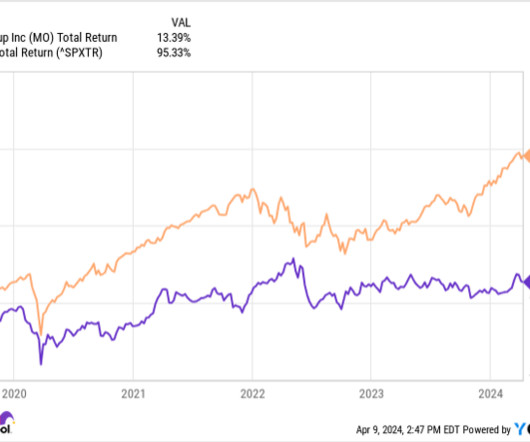

Target (NYSE: TGT) has launched a subscription service that could improve customer loyalty and give added value. But this isn't just any subscription; it's a model that Target is partly copying from Costco (NASDAQ: COST). In this video, Travis Hoium covers the business model Target is employing with its membership. *Stock prices used were end-of-day prices of April 9, 2024.

Let's personalize your content