This 7.9%-Yielding Dividend Stock Continues to Pump More Income Into its Investors' Pockets

The Motley Fool

APRIL 28, 2024

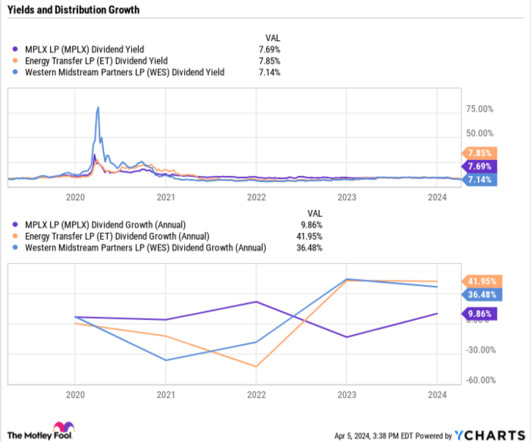

It was able to steadily chip away at its leverage ratio , driving it down to its 4.0 The MLP generates significantly more cash than it distributes to investors -- $3.6 It expects leverage to be toward the low end of its target range this year. That strategy has paid off. target range within the last year. billion-$14.8

Let's personalize your content