Why Global-e Stock Jumped 16% in December

The Motley Fool

JANUARY 8, 2024

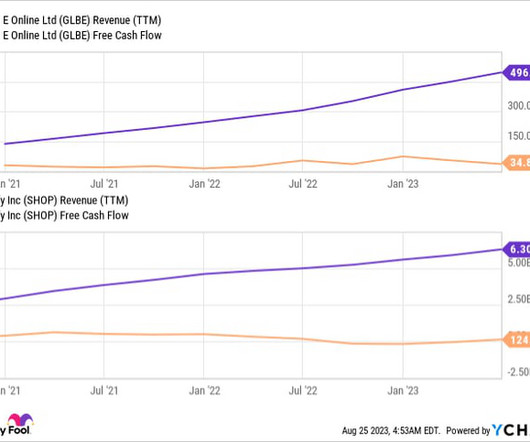

Adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ), which removes things like one-time charges and expenses related to the initial public offering, increased from $12.5 It's still in its unprofitable, high-growth stage, but adjusted gross margin expanded from 41.5%

Let's personalize your content