Why Cracker Barrel Stock Dropped Like a Rock Today

The Motley Fool

MAY 17, 2024

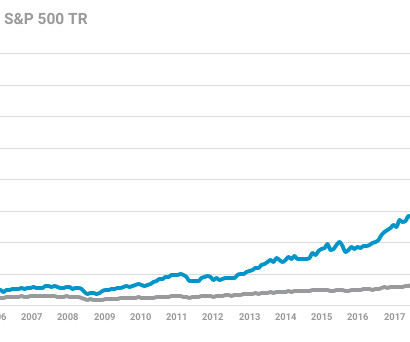

However, by fiscal 2027, it believes it can earn roughly $400 million in adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ). As of this writing, the company has an enterprise value (EV) of $1.7 For perspective, it had less than $300 million in its fiscal 2023.

Let's personalize your content