How to Do Due Diligence When Buying a Business

Hedgestone

JUNE 28, 2023

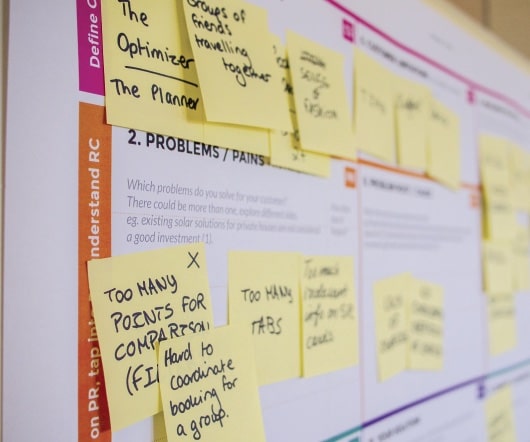

One of the most crucial steps in the process is performing due diligence. Due diligence is an investigation into the business you’re considering buying to ensure that it’s a viable investment opportunity. Step 4: Evaluate the Market Evaluating the market is another critical step in due diligence.

Let's personalize your content