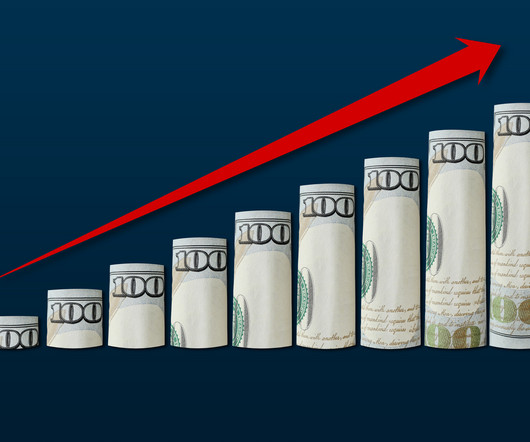

1 Wall Street Analyst Thinks Sea Limited Stock Can Reach $87. Is It a Buy at About $68?

The Motley Fool

MAY 16, 2024

The company's financial services segment outperformed with adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) that soared 50.3% SPX Express completed deliveries within three days or less for about 70% of all orders placed in Asia during the first quarter. of its total loan portfolio.

Let's personalize your content