2 Ultra-High-Yield Dividend Stocks to Buy Hand Over Fist

The Motley Fool

MAY 5, 2024

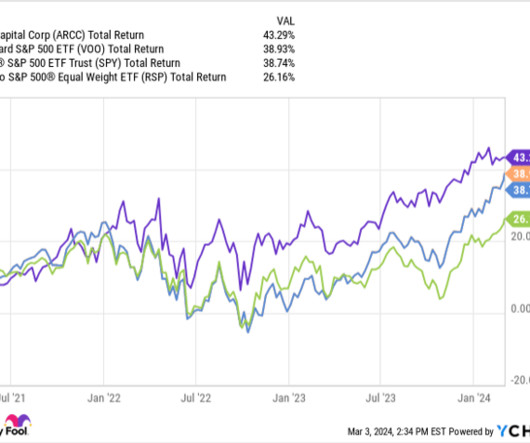

As the largest publicly traded business development company ( BDC ) in the U.S., Ares provides private companies with the cash they need to expand. It specializes in loans to "middle-market" businesses that typically have sales of between $10 million and $1 billion.

Let's personalize your content