Want an Extra $500 in Annual Dividend Income? Invest $5,890 in These 3 High-Yield Dividend Stocks.

The Motley Fool

MAY 7, 2024

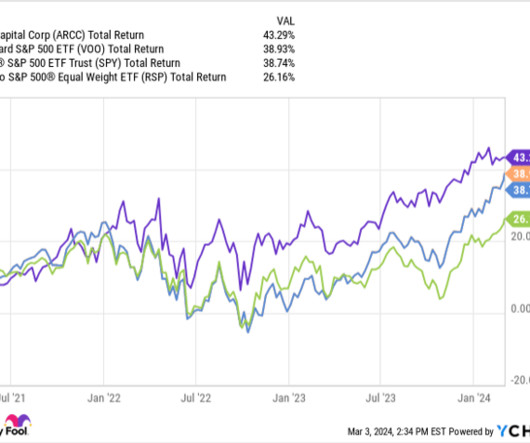

These three stand out because their underlying businesses appear capable of meeting their current obligations and raising their yields higher in the years ahead. Hercules Capital Hercules Capital is a business development company ( BDC ) that allows anyone with a brokerage account to participate in exciting venture capital investments.

Let's personalize your content