Bank of America (BAC) Q4 2023 Earnings Call Transcript

The Motley Fool

JANUARY 12, 2024

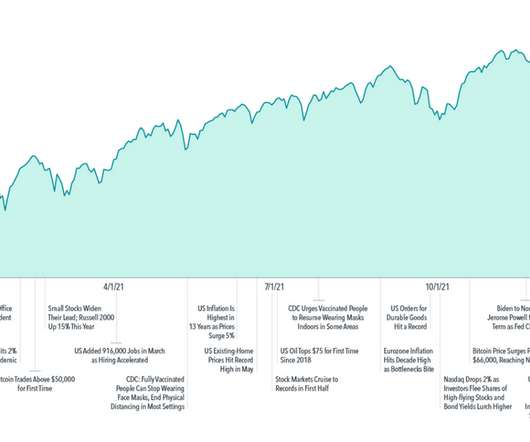

Bank of America (NYSE: BAC) Q4 2023 Earnings Call Jan 12, 2024 , 11:00 a.m. ET Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: Operator Good day, everyone, and welcome to Bank of America's earnings announcement. Should you invest $1,000 in Bank of America right now? economy to a soft landing.

Let's personalize your content