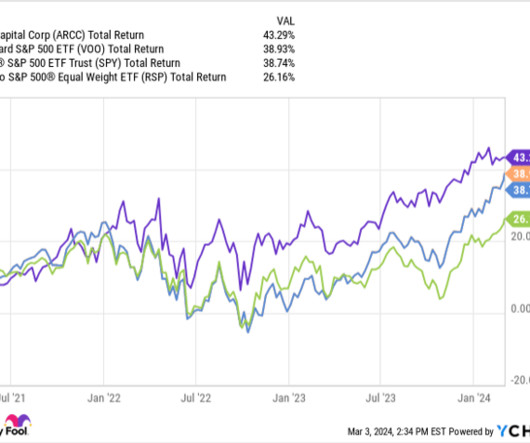

1 Ultra-High Dividend Yield Stock to Buy Hand Over Fist in 2024

The Motley Fool

DECEMBER 15, 2023

Business development companies (BDCs) can be a great source of dividend income, in part because they are required to pay out at least 90% of their taxable income each year as dividends. The investment firm New England Asset Management (NEAM) is a subsidiary of Berkshire Hathaway.

Let's personalize your content