These 3 Companies Have Collectively Repurchased $1.07 Trillion of Their Own Stock Since the Start of 2013

The Motley Fool

MARCH 19, 2024

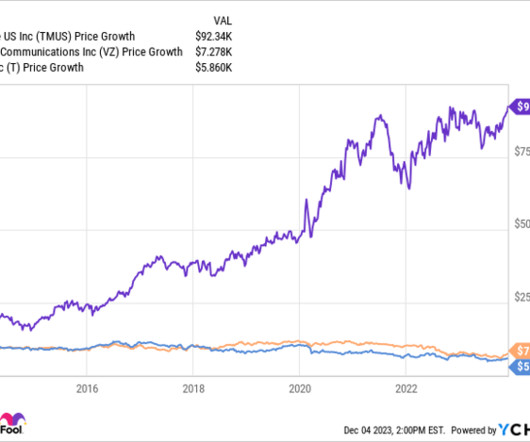

Since 2013, the following three widely owned companies have collectively repurchased $1.07 Apple: $651 billion in share repurchases since 2013 When it comes to share repurchases, it's fair to say that tech stock Apple (NASDAQ: AAPL) is in a class of its own. trillion worth of their own stock. billion to $97 billion for the year.

Let's personalize your content