Wells Fargo Pays $40 Million to Customers for Excessive Fees

The Motley Fool

SEPTEMBER 10, 2023

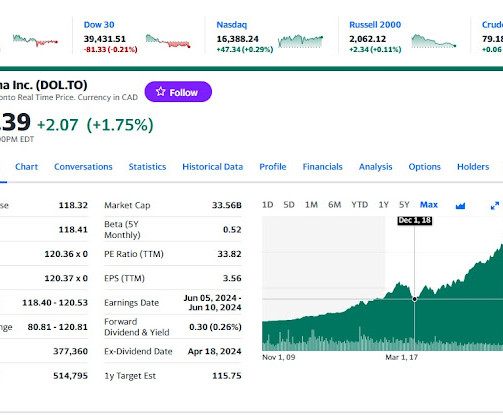

For example, if you buy a mutual fund, you'll pay a one-time fee. Look at the opening documents, account statements, confirmation, and any product-specific documents to find both the type and the amount of fees. Transaction fees are charged each time you make a transaction.

Let's personalize your content