4 Vanguard ETFs That Can Serve As a Complete Income and Capital Appreciation Portfolio

The Motley Fool

DECEMBER 16, 2023

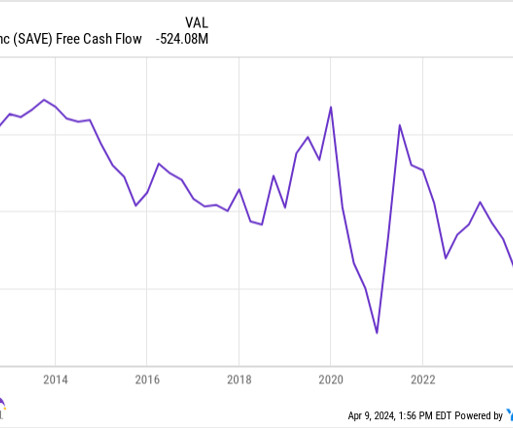

Furthermore, there is no need to use risky strategies such as put-underwriting to generate meaningful levels of income from an equity portfolio. The Vanguard dividend portfolio For this example, I'm selecting four Vanguard ETFs that have a strong track record of both paying dividends and generating positive returns over the prior 10 years.

Let's personalize your content