Better Cybersecurity Stock: Palo Alto Networks vs. CrowdStrike

The Motley Fool

MAY 18, 2024

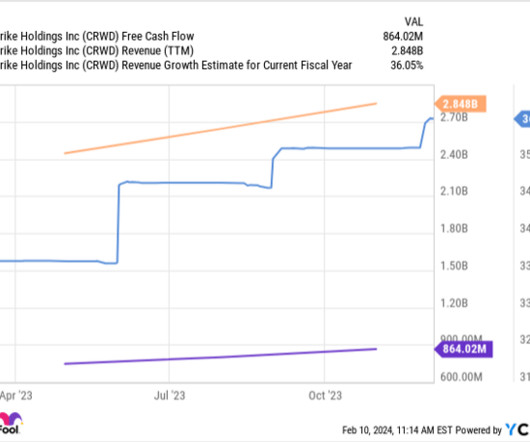

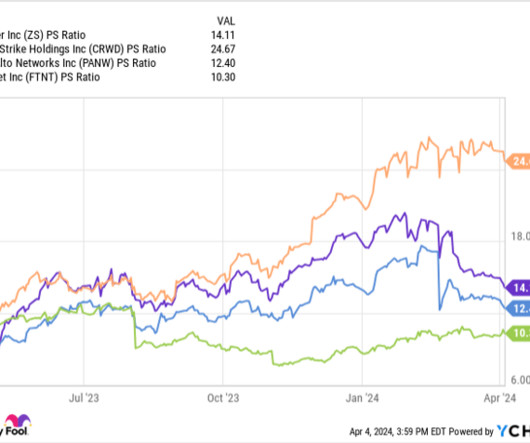

Two of the most popular are Palo Alto Networks (NASDAQ: PANW) and CrowdStrike (NASDAQ: CRWD). Palo Alto divides its business into three segments: network security, cloud security, and security operations. Palo Alto divides its business into three segments: network security, cloud security, and security operations.

Let's personalize your content