Taking Charge of Your Aging Parents' Finances? Here's Who to Talk to First.

The Motley Fool

JULY 9, 2023

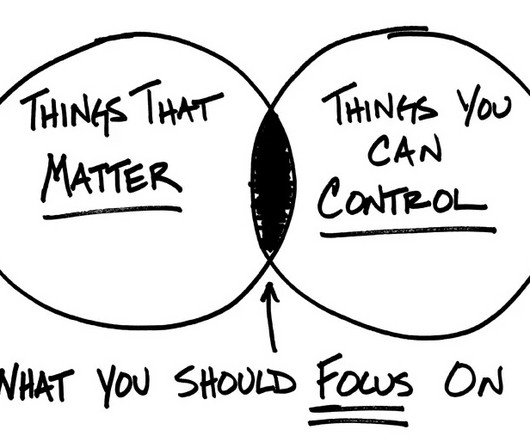

That unpaid care often includes taking responsibility for their aging parents' finances. Your parents The crucial first step is honest, open conversation with your parent or parents about the state of their finances. You should also be aware of your potential personal liability for your parents' expenses.

Let's personalize your content