This Oil Stock Is Following Leaders ExxonMobil and Occidental Petroleum by Making a Major Acquisition

The Motley Fool

JANUARY 5, 2024

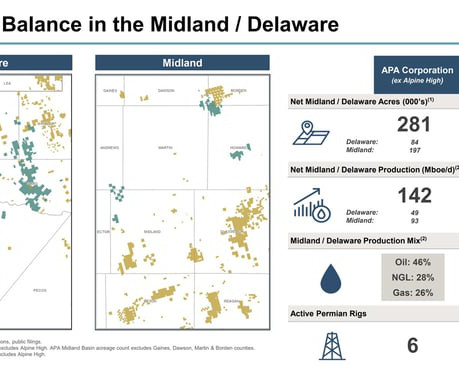

The merger wave in the oil patch is continuing in 2024. That acquisition will enhance APA's scale in the resource-rich Permian Basin. Here's a look at the latest oil stock merger and what it means for investors. Drilling down into the deal APA Corporation is buying Callon Petroleum in an all-stock deal valued at $4.5

Let's personalize your content