This 3-Year Initiative Could See Big Returns for Long-Term Cruise Stock Investors

The Motley Fool

JANUARY 6, 2024

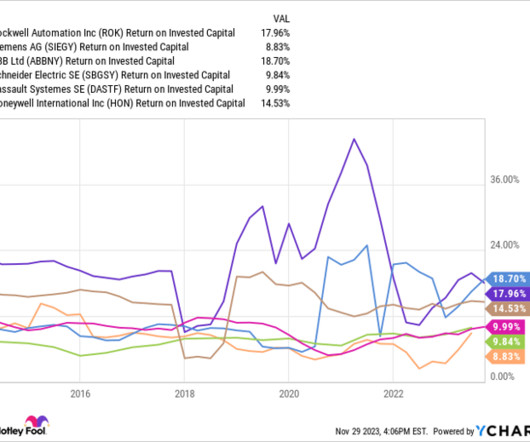

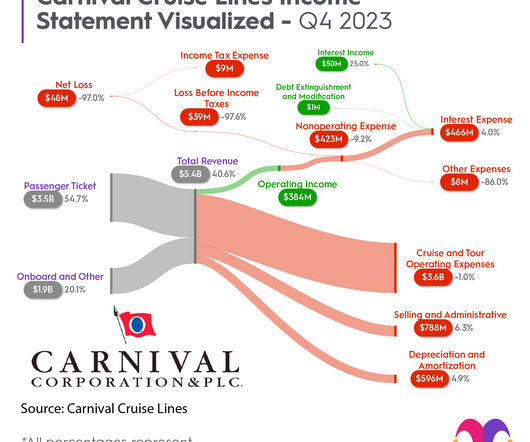

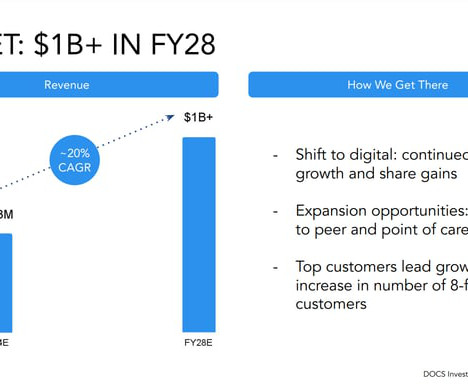

This three-year strategy -- introduced in June 2023 -- is a comprehensive approach aimed at bolstering Carnival's financial health, as indicated by improvements in earnings before interest, taxes, depreciation, and amortization ( EBITDA) and return on invested capital ( ROIC).

Let's personalize your content