I'm Still Missing a Key Tax Document. What Are My Options?

The Motley Fool

APRIL 5, 2024

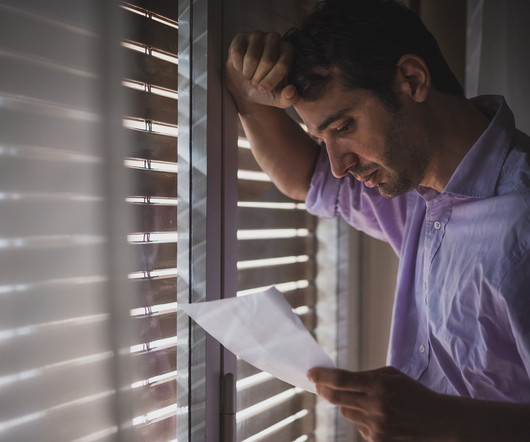

Image source: Getty Images The April 15 tax-filing deadline will be here before you know it. At this point, you've hopefully either submitted your taxes or are gearing up to do so. But what if you haven't filed your taxes yet not due to procrastination, but because you're still missing some key tax forms?

Let's personalize your content