Retiring Abroad? 3 Important Tax Implications to Consider First

The Motley Fool

SEPTEMBER 18, 2023

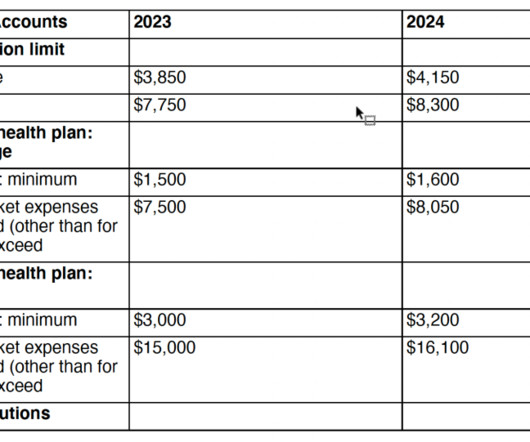

This article is intended for educational purposes only and is not legal advice. But those riches can come at a cost, especially if you're not hip to the tax laws you're beholden to, both here and in your new chosen land. tax return every year. tax return every year. Below are three broad considerations to keep in mind.

Let's personalize your content