Is 3M Spinoff Solventum a Buy? (And What It Means for 3M Investors)

The Motley Fool

MAY 17, 2024

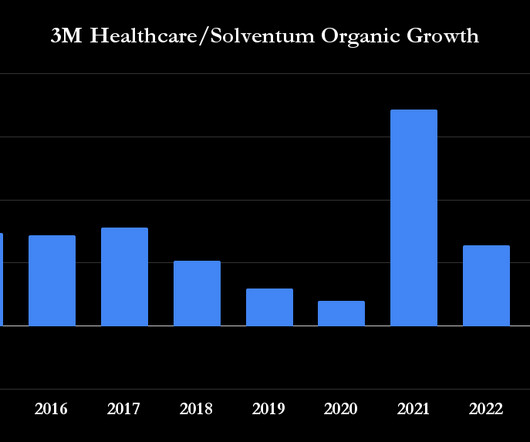

In reality, two new companies came out of the spinoff of Solventum (NYSE: SOLV) and 3M (NYSE: MMM) -- a newly created healthcare company and an industrial conglomerate without a healthcare business. Third, it's worth noting that 3M Healthcare/Solventum was the focus of 3M's merger and acquisition activity over the past five years.

Let's personalize your content