Is Matterport a Worthy Merger Arbitrage Play?

The Motley Fool

MAY 28, 2024

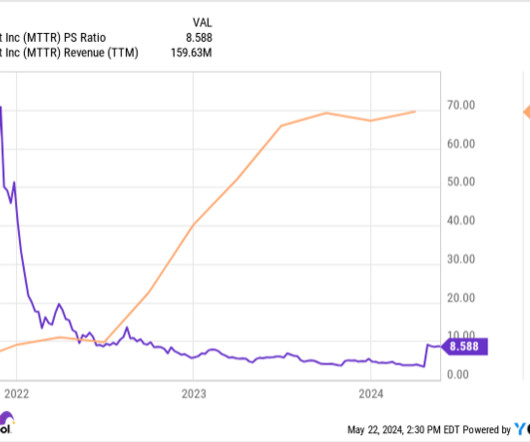

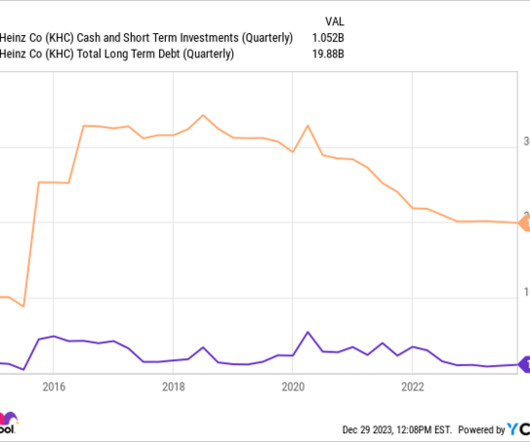

CoStar Group (NASDAQ: CSGP) , the parent company of Apartments.com and Homes.com, announced its intention to acquire Matterport (NASDAQ: MTTR) , a virtual tour software platform, for an enterprise value of $1.6 or more 0.02906 shares Matterport's Merger Arbitrage Opportunity As of this writing, Matterport trades for roughly $4.40

Let's personalize your content