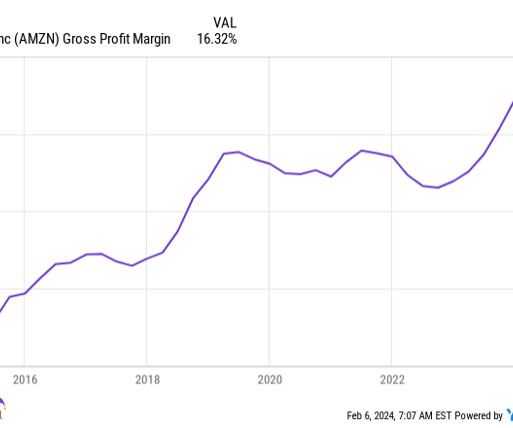

Is Amazon Web Services (AWS) a Liability for Amazon?

The Motley Fool

FEBRUARY 9, 2024

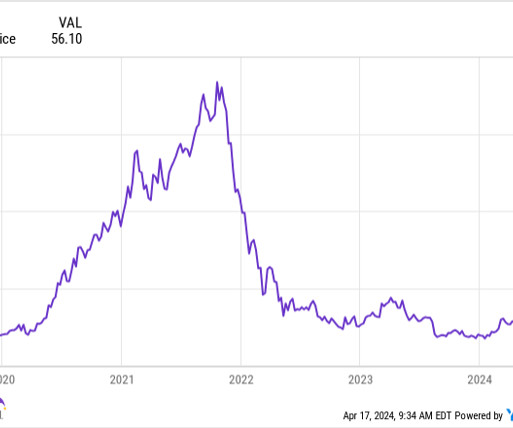

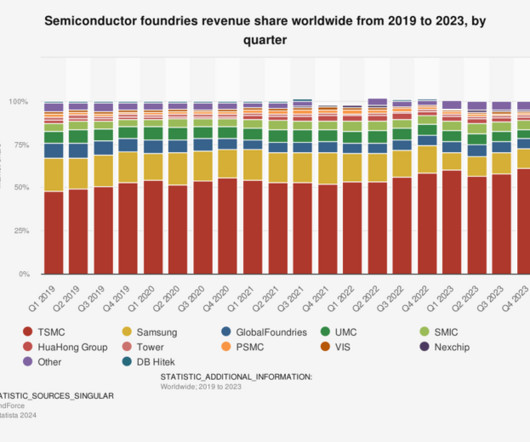

Amazon (NASDAQ: AMZN) is known for e-commerce, but the company has a lot more going for it than that. So, is AWS starting to become a liability for its parent? This allows companies to stay nimble and scale up or down when necessary. The 10 stocks that made the cut could produce monster returns in the coming years.

Let's personalize your content