Why Enterprise Products Partners Isn't the Same Company It Was 5 Years Ago

The Motley Fool

SEPTEMBER 2, 2023

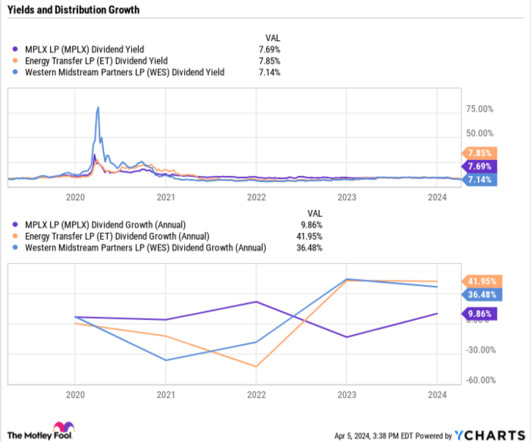

Companies evolve and change over time, particularly those that have long operating histories. The way that midstream companies tend to grow is through the addition of new assets. That can come via acquisitions of existing infrastructure (or entire companies) or from ground-up construction. This is important.

Let's personalize your content