The UItimate Cryptocurrency to Buy With $1,000 Today

The Motley Fool

APRIL 22, 2024

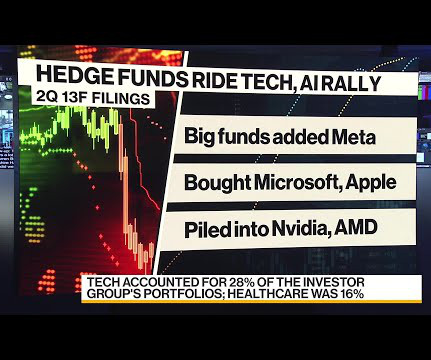

Previously confined to traditional assets like stocks, bonds, and mutual funds, the $100 trillion wealth management industry now has direct access to Bitcoin. Various simulations and studies have been conducted to determine just how much capital that could be, with many suggesting about a 2% allocation as a safe bet.

Let's personalize your content