Is Kinder Morgan Stock a Buy?

The Motley Fool

DECEMBER 8, 2023

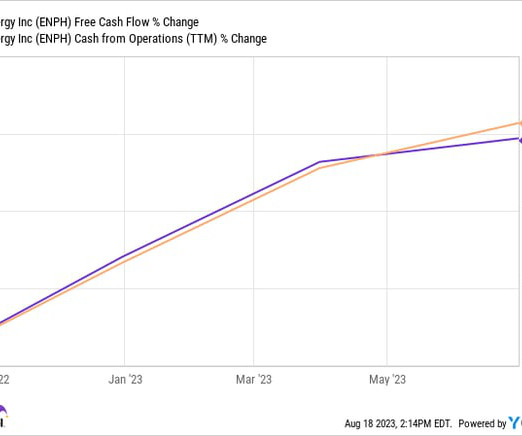

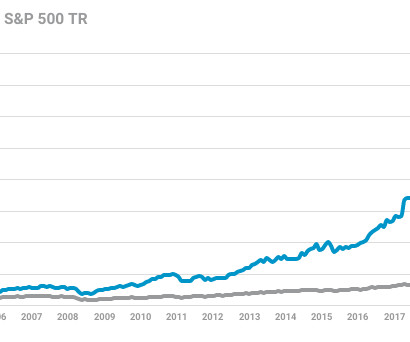

This was done because management had to choose between paying the dividend or putting money to work in capital investment projects that would grow the company. KMI Financial Debt to EBITDA (TTM) data by YCharts That said, a part of the problem was Kinder Morgan's more aggressive use of leverage than its peers'.

Let's personalize your content