If You Invested $10,000 in BigBear.ai in 2021, This Is How Much You'd Have Today

The Motley Fool

MARCH 25, 2024

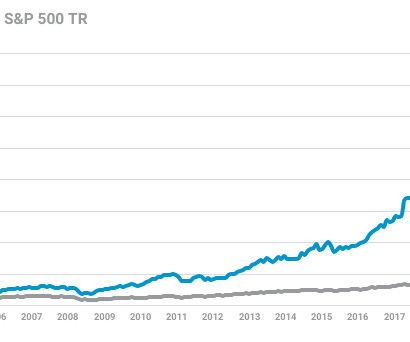

BigBear.ai (NYSE: BBAI) went public by merging with a special purpose acquisition (SPAC) company on Dec. went public, it provided some ambitious growth targets in its pre-merger presentation. BigBear.ai's prospects sounded promising, but it broadly missed its rosy pre-merger targets. and climbed to an all-time high of $16.12

Let's personalize your content