1 Unstoppable Multibagger Up 1,000% Since 2013 That Can't Quit Repurchasing Its Shares. Should Investors Buy, Too?

The Motley Fool

APRIL 6, 2024

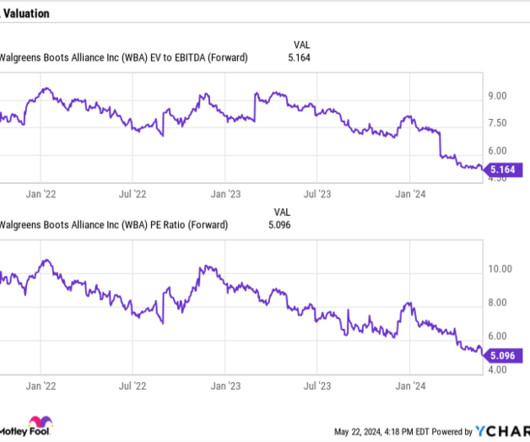

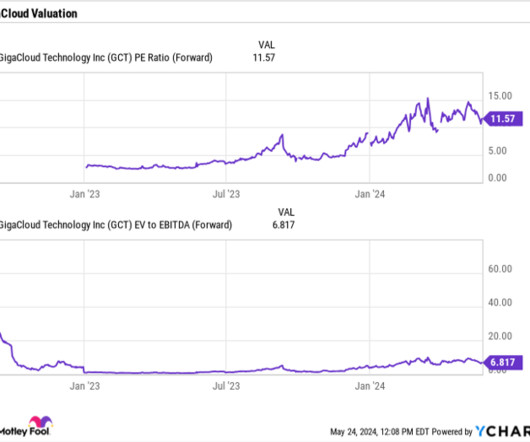

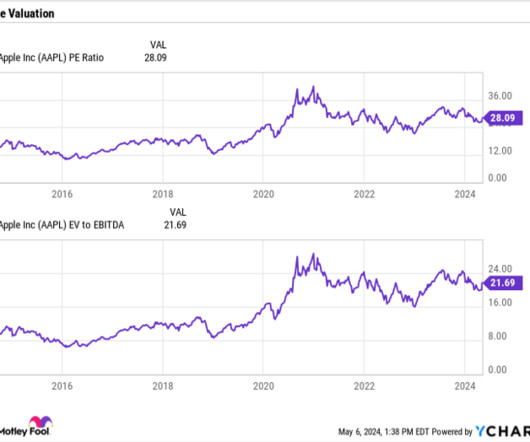

Buying back more than 55% of its outstanding shares over this time has made the company an unlikely multibagger for buy-and-hold investors. The power of share repurchases Best of all for investors, Murphy's fuel margin has been above $0.30 Should investors buy shares, too? MUSA PE ratio data by YCharts; EV = enterprise value.

Let's personalize your content