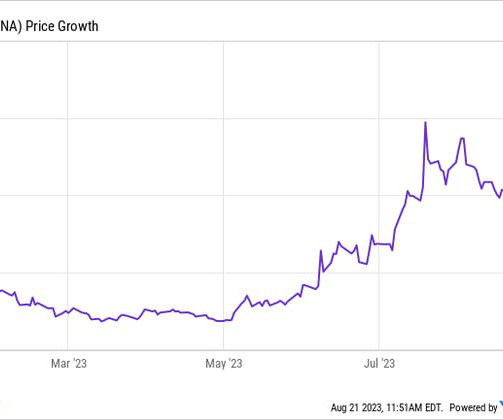

Is Walgreens Boots Alliance Stock Going to $20? 1 Wall Street Analyst Thinks So.

The Motley Fool

FEBRUARY 24, 2024

billion is getting concerning, and the last few quarters have been characterized by selling off hundreds of millions of its investments to pay down its liabilities. At the same time, its debt load of $34.7 Underscoring its increasingly fraught finances, Walgreens' quarterly dividend was cut by nearly half at the start of this year.

Let's personalize your content