Here's the Best Airline Stock to Buy for 2024

The Motley Fool

MARCH 17, 2024

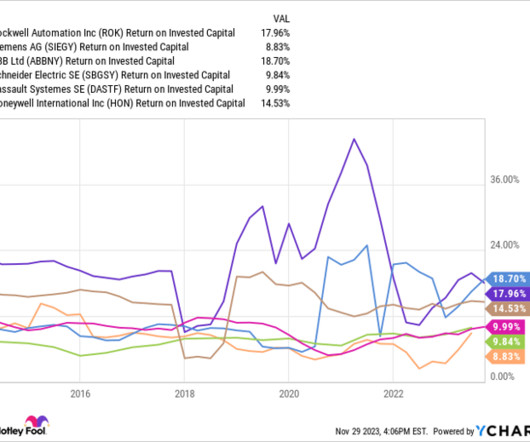

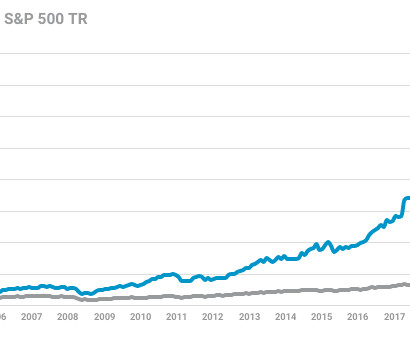

As the International Air Transport Association argues, "Even prior to the COVID-19 crisis, equity owners had not been rewarded adequately for risking their capital," because "average airline returns have rarely been as high as the industry's cost of capital." Using cash flow to pay down debt (adjusted debt fell from $32.9

Let's personalize your content