Cisco Bets Big on Cybersecurity With Its Splunk Acquisition -- Is the Stock a Buy?

The Motley Fool

SEPTEMBER 25, 2023

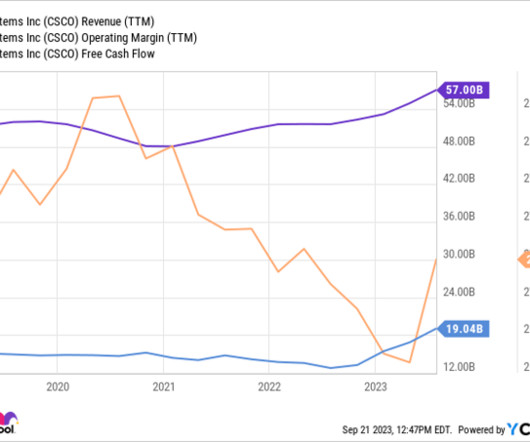

If the deal is approved, it will instantly shoot into the top-five largest software acquisitions ever. billion in debt, at the end of July. Numerous small tuck-in acquisitions have been key, and Cisco has done a bang-up job. If the merger were to take place today, Cisco would nearly double its $3.9

Let's personalize your content