If You Invested $2,000 in Duolingo in 2021, This Is How Much You Would Have Today

The Motley Fool

OCTOBER 16, 2023

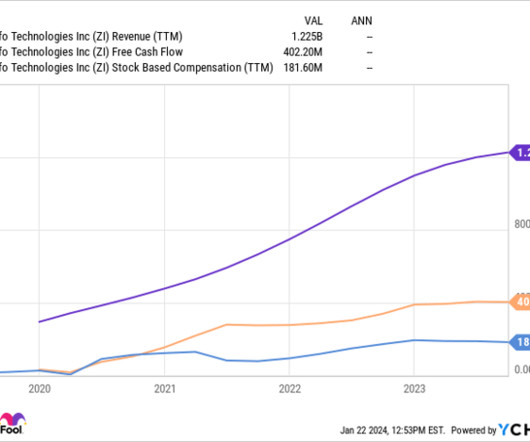

Duolingo (NASDAQ: DUOL) , a developer of learning apps and language certification tests, went public on July 28, 2021, at $102 per share. Nevertheless, a $2,000 investment in its initial public offering would still have grown to over $3,100. Metric 2020 2021 2022 Q1 2023 Q2 2023 Net income ($15.8

Let's personalize your content