If You Invested $5,000 When Dell Went Public Again in 2018, This Is How Much You Would Have Today

The Motley Fool

APRIL 19, 2024

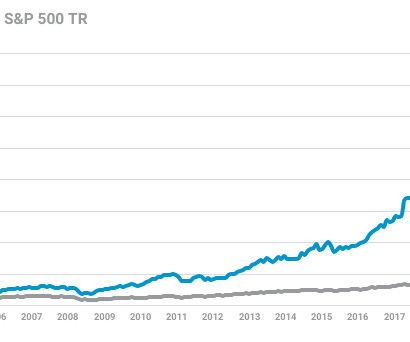

Finally, the company's founder, Michael Dell, worked out a deal to take the company private again. The public history for Dell seemed to be over. But in 2018, it went public once again at about $23 per share (adjusted for subsequent stock splits ). 3, 2018, Dell had a pro forma net loss of $1.2 Why Dell 2.0

Let's personalize your content