Almost Half of Warren Buffett's $374 Billion Portfolio Is Invested in Only 1 Stock

The Motley Fool

APRIL 28, 2024

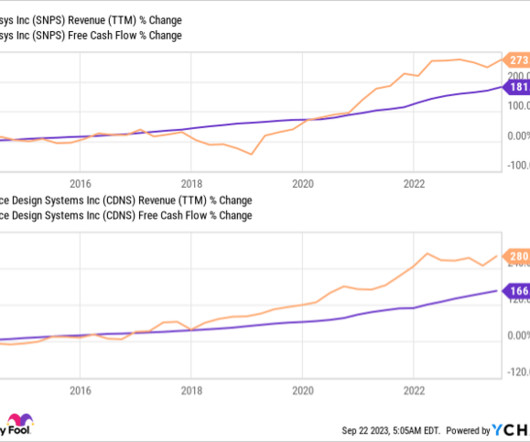

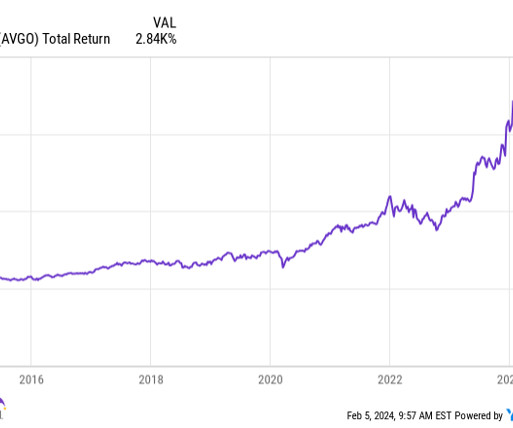

In total, there are nearly four dozen stocks in which the conglomerate has a stake. Warren Buffett first purchased this " Magnificent Seven " stock in the first quarter of 2016. In fact, in surprising fashion, the business posted an 8% revenue drop in fiscal 2016 after sales jumped 28% the previous year.

Let's personalize your content