How Bullish Were You in 2011?

The Big Picture

NOVEMBER 29, 2023

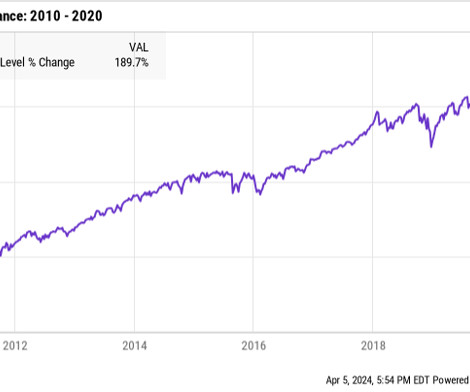

When 2011 saw a flat S&P 500, the negative narratives took on a greater urgency.2 That is price only; the 2009 total return with dividends was +26.5%. 2011 total return was +2.1% The rest of ‘09 saw a fierce rally of 63% in the S&P500 from the March 6th lows; the full calendar year gained +23.5%.1

Let's personalize your content