How Will the Stock Market Perform in 2024? Here's What Wall Street Thinks.

The Motley Fool

DECEMBER 31, 2023

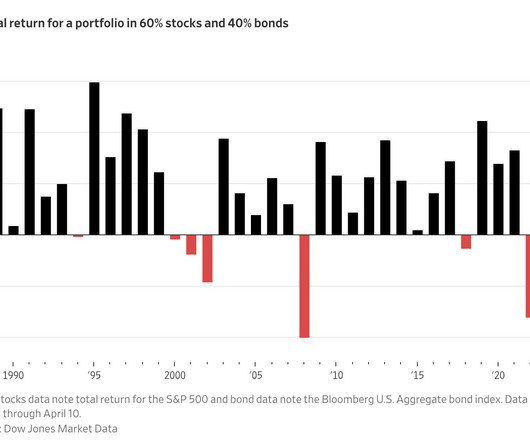

There have been only two exceptions in the last six decades -- one at the beginning of the dot-com bubble bursting in 2000, and another with the financial crisis in 2008. The longer your investing horizon, the bigger the bang you'll likely enjoy.

Let's personalize your content